Shares of Capital One (COF) opened up more than $1.00 this morning, were up more than $2.00 at one point, and now are unchanged after an upgrade to "buy" from Goldman Sachs today. Oftentimes an upgrade will keep a stock up throughout the day, even when the overall market tanks. Not today, though.

One reason might have to do with this Goldman analyst's track record on COF stock. The analyst, Michael Hodes, last had a "buy" on Capital One more than 2 years ago. The stock began 2002 in the 50's and fell to $30 per share by October of that year. Hodes pulled his "buy" rating at $30 and has held to that neutral opinion ever since.

Now trading at $75, Hodes upgraded the shares to "outperform" this morning. Goldman clients must be ecstatic. If analyst ratings were supposed to tell investors how the stock has done in the past, then Hodes' new rating would make sense, as the stock has indeed outperformed, rising 150% in the last 30 months. Too bad that's not what he's supposed to do.

Unlike Airlines, Plains Exploration Updates Hedging Strategy

A press release issued today by Plains Exploration and Production (PXP) shows what smart management teams can do for investors. In prior pieces I have highlighted that mismanagement of oil price hedges has caused the major domestic airlines to lose billions of dollars. A deal announced today by Plains worried me a bit after reading the headline. It said "Plains Exploration to Sell 275 Oil Wells in $350 Million Deal With XTO Energy."

I wondered why Plains, a stock I own personally and for clients, would be selling oil wells at this point in time. After all, those very wells are the reason I own and like the stock. However, after reading the release I realized how great of a move this was.

Plains Exploration will use the deal's proceeds of $350 million to eliminate all existing 2006 oil price swaps and collars. You see, all oil companies have some type of hedging program in place, for the sake of some predictability of cash flow. So even if crude oil was $55 per barrel, energy companies rarely get market prices for all of the oil they produce. Plains has 2006 oil price swaps in place involving 15,000 barrels of oil per day at an average price of $25.28 and an average ceiling price of $34.76. With oil in the mid $50 range, you can see that they would have to leave some profit on the table with these hedges in place.

However, eliminating these swaps and collars will cost about $295 million. The proceeds from the XTO deal will more than cover that expense, and the move will tremendously increase future cash flow. "These transactions remove the significant headwind that the company has experienced in 2004 and 2005 from our previous hedge positions, which negatively impacted cash flow," said Chairman, President and CEO James Flores. In addition, the company has acquired $45 put options on about 40,000 barrels of oil per day in 2006. These options ensure $45 per barrel, whereas the ceiling from their prior swaps was less than $35 per barrel.

Not surprisingly Plains shares are rallying 3% today. Still, shares only trade at 12x 2006 earnings estimates, and those estimates will surely prove too low given the company's new hedging strategy.

Goldman Bullish on Oil, But Why?

Just like I took the "over" for the Wildcats (70 points) when Arizona faced Illinois in the NCAA Tournament Elite 8 last weekend, I'm going to take the "over" again on the number of energy stocks Goldman Sachs (GS) owns. Today's $1+ jump in crude prices is being attributed to Goldman's bullish note today that they see a "super spike" in oil prices on the horizon. Previously, GS had said they thought oil could hit $80 per barrel in such a scenario, but that number was lifted to $105 today, sparking much conversation on the Street.

Call me crazy, but I think the Goldman call had more to do with boosting the stocks they own, rather than some meaningful change in oil fundamentals they saw change overnight. After peaking at $57 or so, oil futures fell $5 fairly quickly in March, leading to a correction in the sector's shares. By raising their already overly bullish view, this slide would quickly turnaround, stopping the losses from their energy holdings and allowing them to unload some stock at favorable prices if they were so inclined.

Qwest: Hang It Up Already

You would think a telephone company would know when and how to hang up a phone. It's like a telemarketer; they're going to give it a good shot, but at some point the odds are good the person you called is going to hang up on you and get back to their dinner. Reports indicate Qwest Communications (Q) is preparing a third offer to buy MCI Communications (MCIP). MCI has already agreed to be bought by Verizon (VZ) twice. Does Qwest really think the third time will be the charm?

MCI wants to merge with Verizon for many reasons, and most have nothing to do with price. If price was the main issue, Qwest would be winning this battle since all of their offers have trumped the Verizon deals that MCI accepted. You really can't blame MCI for continually rejecting Qwest. The companies are like night and day. Verizon is the best telecommunications firm around. Qwest is one of the worst. Verizon has a very healthy balance sheet. Qwest is mired in debt. In fact, according the Qwest's year-end 2004 financial statements, assets less liabilities equals a negative $2.6 billion.

No wonder they are desperate to do the MCI deal. If they don't they're in serious trouble. After going through bankruptcy court, MCI (formerly Worldcom) has cleared its books of billions in debt. Combining their improved finances with Qwest's mess would make for a stronger, larger company. However, Qwest management didn't get the memo yet; MCI isn't going to merge with you. You can make another high-ball offer and go straight to the MCI shareholders for a vote. Only problem with that is, I don't know a single person who would want to own shares in Qwest-MCI.

These desperation tactics make me want to short Qwest shares, as I don't see either scenario (another failed buyout offer or ultimately winning by overpaying for MCI) as boosting shareholder value.

London Exchange Awaits Party Poker IPO

Certain events signal the height of fads, manias, and bubbles. Just think back five years ago when the New York Stock Exchange was considering an IPO. Is it any coincidence that the stock market peaked shortly thereafter? Whether it be the record number of technology sector mutual funds that opened in 1999, or Nasdaq traders quitting their day jobs, we can point to many events that, looking back, should have warned us that there was indeed a stock market mania.

While the company has yet to initiate the process, it is widely expected that PartyGaming, owner of the Party Poker online gambling site, could begin trading on the London Stock Exchange as early as this summer. Analysts have already begun to estimate such an IPO could fetch as much as $5 billion in market value, based on the company's 2004 EBITDA of $350 million. If true, PartyGaming would find itself a member of London's FTSE 100 index.

First it was the World Poker Tour (WPTE) IPO last year, and now Party Poker. Nobody should really be surprised, but the real question is, what can we deduce from this? Would a Party Poker IPO mark the top of a fad, or the beginning of what will become a cultural mainstay? Will WPTE turn out to be worth $19 per share, 16 times forward sales, and 106 times forward earnings? Highly, highly doubtful.

However, it's hard, if not impossible, to know for sure and it certainly gets market observers and poker enthusiasts wondering. Can these companies make enough money to justify their equity valuations, and can those cash flows be sustained and grown long term? It should be interesting to see how it all plays out.

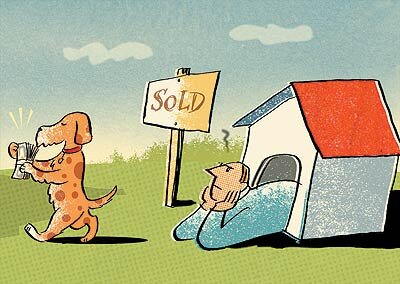

More Proof of a Housing Bubble

Kids are graduating college and immediately buying houses. Rent an apartment? What are you, crazy? Extra cash is being invested, not in stocks (by far the best performing asset class since the beginning of time), but rather in real estate.

When people reflect on the Internet stock bubble of the late 1990's, they often recall shares of Yahoo! and Amazon.com being the most common topics of conversations at dinner parties. Nowadays I find myself at poker games where investing in real estate is the main topic of conversation.

A few months ago, I got an email from a University of Missouri student who had been present for one of my guest lectures during his senior year. He had moved back to St. Louis after graduation and, along with a buddy of his, wanted to meet with me to discuss investment opportunities. Maybe they wanted to take my advice and open a Roth IRA, I thought. I was thrilled to sit down with them and offer some advice.

Turns out Roth IRAs were the farthest thing from their minds. Instead, they had assembled a group of 20 or so friends, most in their early 20's. Their plan was to pool money together and invest in real estate. They figured 20 people contributing $200 a month would net them $10,000 within three months; enough for a down payment on a $50,000 house, which they would then fix and resell for a profit.

This is the type of behavior the current real estate market has induced. Amazing really, given what we all experienced just five short years ago. The logic seems to be that stocks were just pieces of paper, but houses are a much safer asset. Houses might be more tangible, but regardless of what you are investing in, the only thing that really matters is how much you pay for it and how much it will ultimately be worth.

Below is a link to an article from Sunday's L.A. Times (free registration required). If you don't think there is a real estate bubble in this country after reading it, I'd be surprised. The author may be highlighting California-specific instances, but something tells me it's happening in a lot of other states as well.

Raising Rates Like It's 1994

The parallels between 1994-1995 and 2004-2005 are quite striking when it comes to the Fed's interest rate policy and the stock market. History tends to repeat itself in the financial markets, and if indeed today's situation plays out like it did a decade ago, short-term pains could very well reward investors with longer term gains.

First, let's recap how the 1994-1995 period took shape. The stock market rallied nicely in 1992 and 1993 as rates fell and corporate earnings showed healthy gains (not unlike 2003-2004). Chairman Greenspan and the Fed began raising interest rates in 1994, using 7 rate increases to take the Fed Funds target from 3% to 6%. Rather than moving gradually and telegraphing its intentions, the Fed moved very quickly, including two increases of 50 bp and one move of 75 bp.

Many were not prepared for such rapid rate hikes, and as a result, Orange County CA, the Mexican Peso, and Wall Street firm Kidder Peabody spun into crisis. Stocks tumbled throughout much of 1994, dropping by more than 10% at one point. However, a late year rally got the market back to about break-even for the year. The last rate increase came in January of 1995. Once the Fed stopped, the stock market rallied strongly for the duration of 1995, finishing the year with a 37% return for the S&P 500.

Could this time play out similarly? Ironically, the Fed's recent 25 bp rate hike, to 2.75%, marked the 7th rate hike since last year. A similar move to 1994 (300 bp from the lowpoint) would put interest rates at 4% when all is said and done, as the Fed Funds rate bottomed at 1% last year. Much like 1994, stock prices have struggled this year as rate increases are showing no signs of letting up.

The similarities are too noticeable to ignore. The Fed has acknowledged that it raised rates too quickly in 1994-1995 and therefore has chosen to move more slowly and steadily this time around. Whenever they decide they have stifled inflation enough, I wouldn't be surprised to see the 1994-1995 scenario continue to play out, with the stock market finally able to make meaningful headway to the upside. Until that happens, 2005 could very well play out just like 1994; painful short-term, but paving the way for gains later on down the road.

As for specific investment strategy, it's not surprising that financial stocks have struggled since the Fed began raising rates. This trend is likely to remain intact as long as Greenspan continues his current course of action. However, financial services stocks are getting very attractive on a valuation basis. Waiting for the last rate hike before buying them will cause one to miss part of the move upward when the Fed is done, since the market will anticipate it ahead of time.

Adding some bank stocks as the tightening cycle winds down should prove very profitable for investors. Check out the chart below of Citigroup from the aforementioned 1994-1995 period. The Fed stopped the rate hikes in early 1995, leading to a huge move in the group.

From The Economist

IAC/InterActive Blasted for Jeeves Buy

There have been some very interesting developments with the announced purchase of Ask Jeeves (ASKJ) by Barry Diller's IAC/Interactive Corp. (IACI). You would think they were buying some money-losing start-up based on the backlash from the investment community.

Analysts are mostly negative on the deal, even though Diller is getting a very profitable search company at a discounted price. When you have a vast network of commerce-related Internet sites across the web, it seems to make strategic sense to buy a search company to complement them. After all, web surfers can ask Jeeves where to get a great rate on a cruise and he can send them to Expedia or HotWire, both owned by IAC/Interactive.

Even still, debt agencies Moody's and Standard and Poor's are putting IAC's debt on credit watch, hinting they might cut the company's bonds to junk status (they currently are rated one notch above junk), citing the cash outlay needed to pay for the acquisition and invest in the business going forward.

The funny thing is that IAC paying for Jeeves with stock not cash, ASKJ is profitable and cash-flow positive, and the deal will be accretive in 2005. Diller actually wanted to pay cash, but Jeeves' management asked for stock instead. Yes, you heard that right. A second-tier Internet company wanted to take stock, not cash, when it sold out. That is the first time I've ever heard of that happening.

Management at ASKJ explained that they wanted to have the ability to capitalize on the prospects for growth at the combined company in the future, and having a stake in the new company would allow for that. If that's not a ringing endorsement for IACI shares at $21 a share, I don't know what is. I happen to agree that IACI shares look relatively cheap.

Okay, back to these credit outlook downgrades. It is true that Diller intends to buy back 60% of the shares issued to Jeeves, in order to ensure the deal is accretive to earnings in 2005. Isn't this a good thing? The rating agencies seem to think that the $1.1 billion needed to do this is going to put the company's balance sheet in dire straits.

Maybe they are looking at the $1.15 billion of cash on IACI's balance sheet at year-end and thinking that their cash will be wiped out by this deal. However, the company also has $2.4 billion worth of short-term marketable securities (mostly fixed income) and $1.6 billion of long-term investments (maturities of greater than 1 year) on the books as well. Ask Jeeves even has $110 million in cash itself. This company is hardly scrapping for cash. Yet, the yields on the firm's 7% notes have widened to 160 bp over treasuries.

All of this negative talk seems to be an overreaction to me. IAC is set to spin off its travel business, to be named Expedia, and the stock is sitting near multi-year lows. If it falls to $20, or if the bonds continue to trade poorly on comments from Moody's and S&P, I think investors should take a close look if they would like some Internet exposure in their portfolios.

Watch for Downgrades of Home Depot

With interest rates on the rise and talk of a housing bubble not slowing down, I am anxiously awaiting some downgrades of Home Depot (HD). The stock is already fairly cheap, trading at $37 and change or 14.8x 2005 EPS estimates. However, in the current environment that multiple could contract further.

I wouldn't be surprised to see analyst downgrades of the stock shortly. The argument they'll make will be pretty straightforward and logical. As interest rates rise, the housing market will slow and existing homeowners will have less money to spend on home improvements. As a result, HD's sales will slow and earnings will be at risk.

These types of comments, while mostly true, will present investors will an opportunity to buy the stock, not sell it. Worries about these things tend to be overly dramatic. And stocks tend to overreact to news as well, especially negative Wall Street comments. If HD shares drop into the low 30's, the stock will trade at about 13x earnings. At that point, I think investors should use the doom-and-gloom scenario to step and buy the stock.

There is no guarantee the downgrades will come, but with 13 research departments rating Home Depot a "buy" and only 1 a "sell," there are plenty of possibilities. We only need a couple of those analysts to pull their buy ratings to get a meaningful reaction.