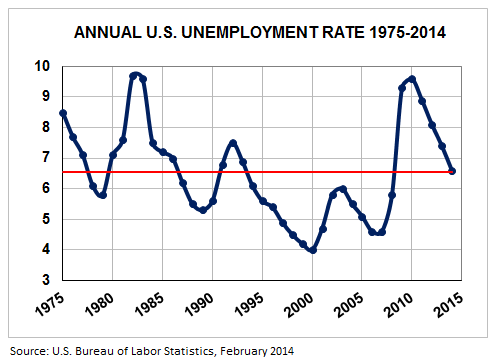

Since the political party in power will always try to spin economic data postively, while the opposing party tries to convince you the country is still in the doldrums, sometimes it's nice to put metrics like the U.S. unemployment rate in perspective by showing historical data without political interference. Accordingly, below is a chart of the unemployment rate over the last 40 years. As you can see we are back down to "average" today (the 40-year mean is the red line), so things are neither great nor terrible. That's surely not what you'll hear as the mid-term elections get into full swing this year, but that's yet another reason why politics and investment strategies shouldn't be mixed. Investing is far more dependent on reality than politics.

Checking In On A Sears Property Slated For Possible "Box Split"

Sears doesn't have a sales problem, it has a profit problem. Whether you agree or not (my personal view is that a sales problem both contributes to, and serves to exacerbate, an underlying profit problem), that's the conclusion drawn by CEO Eddie Lampert. As a result, he is closing dozens of stores and trying to figure out ways to make others smaller (and therefore perhaps more profitable).

In fact, Sears has a relatively new subsidiary called Seritage Realty Trust that has been given the task of managing (read: restructure and/or redevelop) about 10% of Sears' locations. Seritage has its own web site, with many of its projects listed. Included on that list are locations tagged for a "box split," which means they would like to subdivide the current store and rent out space to another retailer. The thesis is that Sears will make more in rental income from the subleased square footage than it did using it to sell Sears' inventory. In addition, they could see sales per square foot increase in the Sears store that remains open by rationalizing their product selection. Overall, it's an interesting strategy with potential, but since it is early in the process it is also largely unproven.

There are only 9 "box split" store candidates listed on the Seritage web site and it just so happens that one of them (the Alderwood Mall store in Lynnwood, WA) is only about 30 minutes north of my home in Seattle. This past weekend my wife and I drove up there to check out a new mall (we've only lived here for about 6 months) and see what, if anything, of note was happening at the Sears store. Perhaps not surprisingly (given that we are talking about Sears after all), there were some good things, some bad things, and some strange things going on.

First, some good things if you are rooting for Sears to find its footing:

1) The Alderwood Mall is a high-end mall (owned by GGP) located in a suburb of a relatively wealthy city.Sears owns the store outright (it's not leased). The two floors are 82,000 square feet each, excluding a 13,000 square foot Sears Auto Center attached. You might not think the fact that the mall is high-end jives with the core Sears customer (and I would not disagree), but the real value here is in the fact that the real estate is owned and high end mall space is worth top dollar.

2) This store (not surprisingly given it was selected for Seritage's portfolio) appears to be an excellent candidate for a "box split." At ~165,000 square feet it has more floor space than Sears really needs (you should see how many clothes this place is stocking), and it has two exterior entrances but just one mall entrance. This means Sears could split the box in such a way that another retailer could occupy half of the first floor (40,000 square feet) and have a dedicated entrance from the parking lot, while Sears could retain one exterior entrance as well as a mall entrance. Here's a map of the mall:

3) Despite Sears being known for skimping on capital expenditures since Eddie Lampert took over as Chairman, this store was not falling apart like many others. In fact, it appeared to be in very good condition despite being built in 1979. It's good to see that capex reductions are not happening at the "best of the best" locations in the Sears property portfolio.

So that's the good news. But it's not all good, especially considering that this idea is still very much a development concept. There were no signs of any construction or preparation work being done in the store that would lead one to believe any tenant is close to signing a lease at this location and has asked Sears to get the ball rolling.

You can probably guess what kinds of things stood out as being "same ol' Sears." My biggest gripe with the chain has always been that Sears stores are almost always terribly disorganized, making for a miserable shopping experience. It boggles my mind when I go inside one because all I can think to myself is, "has a senior manager ever walked this store, and if they have, how could they not realize that if you simply cleaned up the clutter and organized the inventory in a better way, you would likely see better sales production?" It really doesn't take much money (or any) to focus on organizing stores better, it's just time and effort.

How bad was it? Well, how about some pictures:

As for Jackson Hewitt, that's not the only place they are advertising; they are also targeting shoppers before they even get to Sears:

We also checked out the Lands End section. This is a case where not only does the merchandise they pair with the men's clothing section make absolutely no sense, but I question why Sears even carries the products at all (stuffed bears in the kid's section at least would make sense).

My wife was actually looking for Lands End socks, but couldn't find any on the floor, so we asked one of the dedicated Lands End employees for assistance. Despite the fact that she only works in a small section of the store (Lands End shops in Sears stores average 7,400 square feet, which is less than 10% of the first floor of this particular store), she didn't even know if they had any socks in stock. "It's really hard to keep track of where things are," she said. "They move everything around so much."

So not only is the store disorganized for shoppers, but the Lands End employees can't even keep tabs on their own inventory. Again, management here is a serious problem. Sears gets called out for skimping on store upkeep, but this is simply an organizational and inventory management issue having nothing to do with money. We finally found maybe 10 pairs of women's socks on display after wandering the department for a few minutes. None of them were black (a common sock color!?), the color my wife was looking for, so we left the Lands End department empty-handed.

This brings up another issue, because a big part of Eddie Lampert's "integrated retail" strategy involves carrying less inventory in the actual stores, but installing kiosks that allow you to order online while in the store, in case you need a size they don't have, or one of the various colors that they don't stock in physical stores at all. In one of the rare interviews he agreed to do, Lampert explained his thinking to the Chicago Tribune:

"The integrated retail part of our strategy is really about how you work between online, mobile and store, not just from a customer standpoint, but from a supply-chain standpoint," Lampert said. "If we have a shirt in the store in four colors, we might have that shirt in 10 additional colors online. To have 14 colors in the store may be too risky because what you don't sell, you end up losing money on, (compared with) having a group of it online that serves all the stores so that if people want more variety, they can get more variety."

This may sound like a good idea at first blush, but most people who prefer to shop online aren't coming to your store to then order at a kiosk or their smartphone. More likely, they are in your store because they want to try on or see the actual item prior to buying. If you don't have black socks in stock, and there 100 other stores in the mall, I think that customer is more likely going to go buy from a competitor. Contrary to what Lampert seems to think, ordering online from an actual store is not always convenient for the shopper. If they wanted to order from your web site, they never would have driven to the mall. And if they wanted to buy a physical product from a store, they are likely going to find better selection elsewhere in that very same mall.

In addition, I am baffled as to why Lampert believes those extra 10 colors sitting in a warehouse awaiting an online order are any more profitable than those same colors sitting in the store awaiting an in-person buyer. Sure you could argue that warehouse space is cheaper than store space, but aren't the odds higher that someone will see the product and make an unplanned purchase if the item is in a store and not sitting in a warehouse somewhere? Not to mention the fact that Sears shoppers tend to be older, so they are less likely to be avid technology users and more likely to prefer seeing and touching the product before buying it. I think Lampert's integrated retail strategy might work better for some businesses than others, and I don't think Sears is a good fit relatively speaking. Perhaps that is a contributing factor as to why sales trends are so poor right now.

Before heading out of Sears, I also checked out the hard lines department, the biggest segment for Sears. I was impressed with the hardware and tools section (one of the largest Craftsman selections I've seen) and then I ventured upstairs to check out appliances and electronics.

Appliance department is well organized and there were a couple salespeople ready to assist, but what's that in the background?

This just felt strange. Not a very inviting shopping experience. There was one employee manning the jail, and I doubt it would deter you from browsing if you were looking to make an immediate purchase, but it just seemed so unneccesary, and the first of its kind I have seen. I'd be curious to see if shoppers are less likely to browse an enclosed area like this, assuming they weren't looking for something specific, just because it would feel like the employees were more concerned with making sure you didn't steal something, as opposed to enticing you to buy something. My wife and I had a good laugh (and we didn't go inside, though we did have to raise our voice to ask the saleswoman through the glass where the nearest restroom was located).

All in all, it was an interesting trip. Nothing really has changed about my view of Sears though. They still don't seem to know what they are doing when it comes to creating a positive shopping experience, relative to their competition, and although they aren't skimping on upkeep at this valuable piece of real estate, they don't seem to really be focused on maximizing the profits from the store either. The potential redevelopment opportunity from a real estate perspective is definitely there, but progress is slow. At a mall of this caliber (it's a combined indoor-outdoor complex that very much represents the typical high-end GGP mall), you would think Sears could really turn their 165,000 square feet into something unique and profitable. Time will tell.

Full Disclosure: In order to attend the 2014 Sears Holdings annual shareholder meeting (Mr. Lampert rarely speaks publicly outside of this event and this year I decided to go) I am long a small "odd lot" (i.e. less than 100 shares) of SHLD stock. However, this is merely to permit me to attend the meeting and not for investment purposes. In addition, I am long Sears bonds as an investment. Positions may change at any time.

If Your Mortgage Rate Is Meaningfully Above 4.3%, Consider Refinancing Now

Lots of hedge funds are having a very difficult start to 2014. Many were short long-term bonds as a hedge against a correction in U.S. stocks. Despite profit-taking in equities this month, bond prices are surging and yields are falling. The benchmark 10-year treasury bond has seen its yield drop from 3.03% on January 1st to 2.65% today. Mortgage rates have followed suit, dropping to 4.31% (30-year fixed) according to bankrate.com. A 15-year mortgage now costs about 3.35%, nearly a full point lower.

If you have a mortgage with a rate significantly higher (say, 5% or above), I would recommend crunching some numbers to see if refinancing would make sense. I don't expect rates will stay below 4.5% for very long so this pay be one of the last chances to lock in a great rate. Also, people tend to ignore the 15-year mortgage option (the payment is typically about 50% higher than a 30-year mortgage, despite a lower interest rate), but it could very well be an attractive option for some people, especially if your current payment does not make up a large portion of your discretionary income.

For instance, let's say you currently have 20 years and $200,000 remaining on a 30-year mortgage at 5% (monthly payment of ~$1,075). If you could handle a payment of ~$1,425 you could refinance into a 15-year mortgage at 3.5% and have your house paid off 5 years early. The increased cost might not be workable for many, but for those looking to cut monthly expenses or retire as soon as possible, a refinance might aid in the process.

Here's What Not To Say If Carl Icahn Is Breathing Down Your Neck

Ben Reitzes, Analyst, Barclays: "And I guess there’s been a lot of things in the media about your potential to buy back more stock, and shares are around $500 tonight. I was wondering if you thought this was a good level, and whether it was time to accelerate the buyback from current levels. You obviously generated a ton of cash in the quarter, and what are your latest thoughts there?"

Tim Cook, CEO, Apple: "We’ve been buying back stock. As you know, last year we increased the program overall, our cash return, doubling it to $100 billion. And $60 billion of that is buyback, and we’ve been progressing on that. Luca can give you the precise numbers of it. So we’re a big believer in buying back the stock, and that doesn’t change today, whether the stock goes up or down [emphasis added]."

Apple now has $159 billion of cash. That is $177 per share, versus a share price of $510 per share, so more than 1/3 of the value is in the bank, not within its corporate offices, inventory, retail stores, or supply chain. The core operations are trading at around 9 times earnings, nearly a 50% discount to the S&P 500. We know Carl Icahn is begging for an accelerated buyback and is completely justified in asking for one. I'd bet he is buying more stock today. And yet, despite knowing all of this, Tim Cook casually states on the conference call that his willingness to do stock buybacks does not change at all depending on where the stock is trading. I can't wait to read Carl's next letter to the board. And you thought the first one was unapologetically critical.

Full Disclosure: Long shares of Apple, but positions may change at any time.

Why the January Barometer Drives Me Crazy

You can find the "January Barometer" mentioned in dozens of media articles and it has been referenced a ton on CNBC so far this year, as it is every January. Here's a recap from the Financial Post in case you have been lucky enough not to hear about it:

"Stock performance in January can say a lot about where the markets are headed for the rest of the year. At least, that's the premise behind the January Barometer, a theory that the performance of the S&P 500 during the first month will set the tone for the rest of the year... The Stock Trader's Almanac points out that since 1950, the Barometer has been right 76% of the time."

Sounds harmless enough; If January is up, then the market will finish up for the year three times out of four. Good odds, right? So why does this so-called barometer drive me crazy every time I hear it? Because you need context to really determine if this indicator has any value.

Forget January entirely for a second. Would it not be helpful to know how often the market goes up in a given year regardless of any particular month? I certainly think so. In fact, since 1957 (the year the S&P 500 index was created -- don't ask me how they claim to have data from 1950-1956) there have been 56 calendar years and the S&P 500 index has risen 44 times and fallen 12 times. Why is that important? Because 44 divided by 56 equals 78%. The market goes up 78% of the time no matter what!

But if January is up then the market goes up 76% of the time. So what? Actually, that tells me that January has essentially no influence at all. In fact, we could go a step further and say that if January is up, the odds the market will rise for the full year actually go down slightly compared with the historical average. So really, January is irrelevant. It tells us nothing on its own.

It's sort of like saying if you play blackjack in Vegas in January then the house edge is only 1%. That might sound like great odds, until you do some digging and realize that the house edge in blackjack, assuming you follow perfect basic strategy, is actually less than 1% regardless of when you play.