I have been an avid long-term investor in the restaurant space for nearly two decades. I think my first food investment was Panera Bread Company (PNRA), which I was very familiar with due to my undergraduate years in St. Louis. St. Louis Bread Co was acquired by Au Bon Pain in 1993 and about five years later they decided to divest all of their other restaurant concepts in order to focus on rebranding the local favorite "Bread Co" into a dominant national chain called Panera. To this day the company's St. Louis locations retain the original name.

So why do I favor solid investment stories in this sector? Here are some of the most important reasons:

The business model is easy to understand and analyze.

The secular trend of less cooking at home and more dining out (or carry-out) is well established

It is very easy for investors to research how the units operate and sample the product

Smaller chains have a large runway for growth if they decide to expand from regional to national players

Private equity type transactions are common in the industry, which gives investors comparable terms to use for valuation

In recent years, however, the space has gotten very crowded. Many companies have gone public and in order to attract growth investors have promised impressive annual unit growth (10%+ per year in many cases). And there are a slew of smaller, private companies that have major growth plans. Consider two examples that I have encountered in recent years in the Pacific Northwest; MOD Pizza and Little Big Burger.

MOD was founded here in Seattle in 2008 and by 2014 had over 30 locations. After opening up the chain to franchisees, growth accelerated and there are more than 150 units today.

Little Big Burger was founded in Portland in 2010 and after only five years and 10 locations was sold to a largest restaurant operator for $6 million. The company now has plans to open at least 10 units in the Seattle area. Just what we need... another burger place!

We are seeing this all across the country. Rapid expansion of fast casual restaurants in the sandwich, pizza, burger, taco, and burrito spaces, among others. And it's not just the larger players, but smaller concepts too that seem to yearn to play with the big boys. And so now we are facing what appears to be a restaurant buildout unlike anything we have ever seen. But with a population growing at less than 1% annually, and income growth relatively muted, how on earth can we support all of these places? It should certainly be a concern for investors.

And we have seen Wall Street adjust their willingness to assign premium values to publicly traded restaurant stocks. Fast growing concepts used to trade for 10-15x EV/EBITDA on the public markets, versus about 8x for more well known, mature brands (a crummy brand would fetch just 6x). We seem to now have a situation where most stocks in the industry are shifting down to that 8x number. The market is basically saying "we have too many units already, so either you won't open at the rate you are planning, or if you do your profits per unit will go down." Higher minimum wages across the country don't help either.

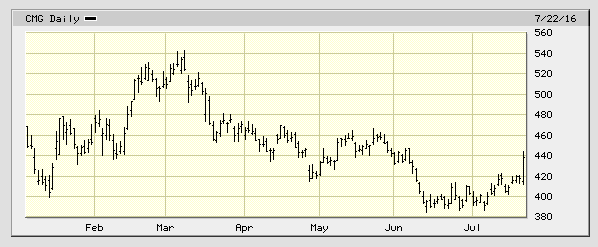

So what are investors to do? I don't think the restaurant space is "uninvestable" by any means, but we need to be more selective about the chains we allocate capital to, and also more strict in our valuation criteria. For instance, I am an investor in Kona Grill (KONA). The full service, sit-down chain will end 2016 with 45 locations across the country. For the third year in a row they are growing their unit base by 20%, which has traditionally afforded it a premium valuation. But recently sentiment has shifted. Below is a 2-year chart for KONA shares:

Fortunately, KONA has a lot of good things going for it. First, the CEO is the largest shareholder. Second, their concept is relatively unique and their units are doing well. Third, they are small enough to grow quickly if they want to (the company recently conducted a third party analysis which found a market opportunity of nearly 300 units in the U.S. alone, though give the content of this post, perhaps that number should be taken with a grain of salt).

As a result, management has publicly indicated that since Wall Street is no longer rewarding 20% annual unit growth, they are going to scale back their expansion plans. Since the CEO owns so much stock, he will likely turn his capital allocation attention to share repurchases. While growth-focused investors likely soured on the stock upon hearing this news (and sold, contributing to recent price declines), I actually applaud the move. With the stock trading at roughly 70% of projected 2016 revenue, retiring existing shares is an excellent use of capital. Coupled with unit growth of, say, 5%, shareholder value creation should follow.

And that is an important point. Since valuations have come down across the board for public restaurant stocks, future gains will be predicated on not only existing unit performance but also on capital allocation. Those companies that opt for share repurchases when their stocks are cheap (and debt repayment if they are not) and tweak their expansion plans based on competitive conditions (as opposed to the rigid plans they have laid out to investors in the past) are likely to be much better performers.

All in all, a lot is changing in the sector, both on the ground and in the financial markets. Recent months have not been kind to stock prices as valuations have dropped considerably, but there definitely attractive investment opportunities if you find proven concepts with management teams that are nimble and change course if conditions warrant. Count KONA as one of those that I believe fits that mold, despite poor recent stock action.

Full Disclosure: Long shares of KONA at the time of writing, but positions may change at any time