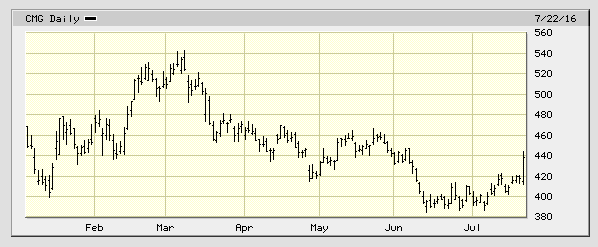

The "we can do no wrong since we already got people sick" trading patterns in shares of Chipotle Mexican Grill (CMG) are continuing unabated after the company reported second quarter earnings that showed a tepid traffic recovery. As you can see from the chart below, Chipotle stock has been hanging in the 400's this year despite a slower than expected return of the company's loyal customer base. It seems like the stock only treads water or rises even as the business is clearly struggling. Today is no exception, with shares jumping to 5% to $440 each despite a 23.6% decline in same store sales for the second quarter.

Despite the headwinds facing the company, investors continue to assign the stock a premium earnings multiple. The stock currently trades for roughly 3 times peak sales ($4.5 billion of revenue was booked in 2015), 30 times peak earnings ($15 per share in 2015) and over 13 times peak EBITDA (2015 EBITDA was ~$925M). Essentially, investors are willing to pretend that nothing has happened and recouping all of the sales and profit losses is a foregone conclusion.

I would not be so quick to discount Chipotle's challenges. There are factors that could easily result in the company never reaching its former level of annual sales per unit ($2.5 million). First, consider that CMG continues to open new units at an aggressive pace (about 225 new locations per year). With more than 2,100 locations nationwide, continuing to open a new one every 39 hours will surely result in store cannibalization. In fact, during the second quarter same-store sales improved versus the first quarter (-23.6% vs -29.7%) but sales per unit actually declined further ($2.07 million vs $2.23 million). As more and more locations are opened, it will be harder for CMG to get that metric back up to $2.5 million.

Second, the sheer volume of new fast casual restaurants being opened (both new concepts as well as the expansion of existing ones) means that Chipotle faces more competition than it ever has. Customers who stopped eating there during the safety scare may have simply found other nearby options that they enjoy just as much. Humans are creatures of habit and if you give them a reason to break their habits (by getting people sick), it is entirely possible that their dining frequency will never return to the previous level, even after they feel safe to eat Chipotle's food again.

All of this could spell trouble for Chipotle investors. The company's simple business model and astounding unit economics allowed it to generate store-level profit margins of 27%, an nearly unheard-of level in the industry. The stock's sky-high multiple reflected an expectation that CMG could see its units average $2.5 million of sales annually along with 27% margins ($675,000 of store-level profit per year). If they can not get back to those levels in 2017 or 2018, investors could very well be overpaying for the stock today. For comparison, right now store-level margins are running at 15.5% due largely to expense deleveraging from lower sales.

So what happens if the "new normal" for Chipotle is $2.25 million of annual sales per store and 20% store margins? Well, the math comes out to per-unit profit of $450,000 per year, or a decline of 33% from last year. That would mean that CMG would need 3,000 locations to get back to its prior peak level of profitability. At the current rate of new store openings, they would reach that size sometime in mid-2020. Paying three times revenue for a restaurant stock is high enough already, but without regaining their former financial glory investors might very well be left with a bad taste in their mouths.

Full Disclosure: No position in CMG at the time of writing, but positions may change at any time