Frightening to think how many retail investors were in this one:

No Bitcoin Bubble Here: Pink Sheet Listed CRCW Market Cap Hits $10 Billion

If you were an active investor back in the late 1990's you probably remember what the climate was like during the dot-com bubble. All a company needed to do was issue a press release announcing they were going to launch a web site to sell their product online and their stock price would skyrocket. This CNET article on oldies music marketer K-Tel, which saw a 10x jump in share price in just a month back in 1998, offers a good refresher.

The current bubble in cryptocurrencies is worse, in my view, because unlike the Internet (which many will agree was the most important innovation of that generation) it is not clear that we really have any need for virtual coins, which like any collectible will see their value swing wildly based on what someone is willing to pay for them on any given day. Maybe I am just ignorant and will be proven wrong in coming years, but I don't see why a bitcoin is any different than a piece of art, a baseball card, or a beanie baby. They all have a finite supply and little or no intrinsic value.

If you need evidence of a bubble in bitcoins and the fact that the price has gone from $3 when I first heard about them in January 2012 (Featured on Season 3/Episode 13 of CBS's "The Good Wife" - streaming available for free on Amazon Prime Video) to $17,000 today is not enough, look no further than shares of The Crypto Company, an unlisted stock trading on the pink sheets under the symbol CRCW.

On November 15th, The Crypto Company announced financial results for the third quarter. There is no business here. Revenue came in at whopping $6,000 (consulting fees). Cash in the bank stood at $2.6 million, plus another $900,000 worth of cryptocurrencies.

How much is a company with a few million dollars of assets and no operating business worth? Well, the stock closed that day at $20, giving it a market value of $415 million (~20.7 million total shares outstanding).

But wait, that's not the crazy part.

Shares of CRCW have surged nearly 24,000 percent in just 30 days since then, valuing the company at $10 billion. That is a bubble, folks.

Even After 30% Decline, Equifax Shares Not Cheap

It seems that data breaches are going to become the norm globally, if they have not already, so whenever a company is hit by hackers and the stock price declines as a result, I try to take a look and see if there are investment opportunities. The best example was Target several years ago, when hackers pierced the retailer's in-store credit card scanners and stole customer payment data. While the media would have had you believe people were going to abandon the chain for life, after 6-12 months (and many more hacks of other companies), it was business as usual.

Equifax (EFX) might be a different animal given that they are in the business of collecting credit data, but most corporations do not seem to be much of a match for professional hackers. So while it is easy to argue that their security should have been stronger than Target's, I am not so sure that a year from now Equifax's business will be materially harmed. It is worth watching, however, since there are other data providers corporate clients can use.

What is interesting to me is that even after large drop (in recent weeks EFX shares have fallen from the low 140's to today's $103 level), the stock is not cheap. In fact, it appears it was quite overvalued leading up to the hack disclosure, making a 30% decline less enticing for value investors.

I went back and looked at Equifax's historical valuations and found that the stock has ended the calendar year trading between 14x and 23x trailing free cash flow since 2010. I would say that 20x is a fair price for the company. But pre-hack the shares had surged more than 20% year-to-date and fetched roughly 27x projected 2017 free cash flow. So at today's prices they still are trading at the high end of recent historical trends at ~20x.

For investors who think this hack will come and go without permanently damaging the Equifax brand, the current price is a discount from recent levels but hardly a bargain. If you are like me and would want to see how financial results come in over the next 6-12 months (to see if customers are bailing), you would want a far better price if you were going to start building a long position now. And even when you felt comfortable with the long-term prospects of the business, the current price would hardly scream "buy" at you.

The stock seems to be acting well in recent days, which suggests many are taking the bullish view. While I don't necessarily think that is the wrong move, recent history suggests the stock isn't worth the $140+ it was trading at prior to the hack.

Full Disclosure: No position in EFX at the time of writing, but positions may change at any time

The Average Investor Can (And Should) Ignore the 60 Minutes Story About "Rigged" Markets

The piece on 60 Minutes this past Sunday has ignited a discussion about high-frequency electronic trading systems and undoubtedly has spiked sales of the new Michael Lewis book entitled "Flash Boys: A Wall Street Revolt" which digs deep into the topic. Since I have yet to read the book, I am not going to get into many details here, but the big issue is that technology has become so advanced these days that certain people are now able to get insights into what orders are coming in for a particular security, and jump in front of those orders to make a few pennies per share on the backs of smaller investors. It's gotten so bad (read: unfair) that a company called Virtu Financial Inc, which recently filed documents to go public, disclosed that it has only lost money on one day out of the first 1,238 trading days it has been operating.

Since I work with regular retail investors, the most salient question my readers might want to ask is "Does this affect me?" I would say "No, it doesn't." There are definitely counter-arguments to be made, but for the typical investor (who is investing in the stock market and planning on holding a stock for months or years) the existence of high-frequency trading firms should not even be a blip on their radar. The market is not "rigged" against the types of investments they are making. If you want to invest in Company A, you have done your research, and you feel as though paying $20 per share for that stock is an attractive price, then all you have to do is enter a limit order to buy Company A at $20 per share. In that scenario, you know what you are getting, you know what price you are paying, and you feel good about your odds of success. Over time if your investment thesis proves accurate then you will make money, and vice versa. Nothing else really should matter to you.

Now, it is hard to argue that we should embrace or even accept a system where certain groups of people with more money and better technology should be in a position to game the system and earn a profit 1,237 out of every 1,238 days the market is open. Hopefully regulators will do everything they can to close these loopholes in the system. That said, the discussion around whether regular investors should change how they save and invest based on this new book or the 60 Minutes segment are focusing their coverage and attention on the wrong headlines, in my view. Carry on.

Dow Jones Industrial Index: Worst Financial Services Stock Picker Ever?

This week we learned that the components of Dow Jones Industrial Average (DJIA) will be changing again later this month. As former blue chip companies become less relevant over time, those who oversee the index seek to modernize it by replacing former darlings with new age companies that are more dominant in the current economy. Not surprisingly, such actions offer an interesting lesson on contrarian investing. To get booted from the Dow 30 a company must really be struggling. Conversely, if you are chosen as a replacement, chances are good that things have been going well lately.

Back in 2005 I talked about this and showed that the stocks that are removed from the Dow have actually outperformed their replacements after the changes were made. So yes, making these changes to the index has actually hurt its long-term performance, even though the motivation is exactly the opposite. While my piece is nearly a decade old, it remains relevant as the trend has not abated in any way. Here is the link: Examining Changes to the Dow 30 Components.

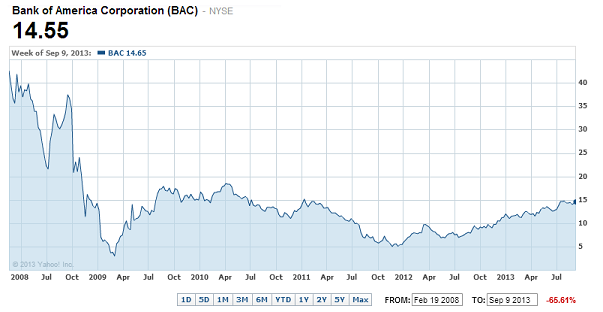

Looking back over the last 15 years shows that the Dow 30 index has been an especially bad timer of financial stocks. Bank of America (BAC) is one of three stocks that is being removed from the index this time around (Alcoa and Hewlett Packard are the others). Amazingly, BAC has only been part of the Dow 30 for five years. Since it was added in February 2008, the stock has collapsed from $42.70 all the way down to its current quote of around $14.50 per share. That 66% decline is quite astounding, as the chart below shows.

Now you might think that Bank of America is an isolated case, because it was added to the index at the peak of the last banking cycle, right before the financial crisis began (great timing Dow Jones!). In fact, mistiming financial stocks is a trick the index keepers have been perfecting for a long time!

Prior to Bank of America, the last large banking-related stock added to the Dow 30 index was.... drumroll please..... AIG! American International Group (AIG) was added to the Dow in April 2004 when it was trading at $76.25 per share. If you thought BAC made a quick exit after five and a half years, AIG lasted only four and a half years. It was removed from the index in September 2008 at the plump price of $3.85 per share, for a loss of about 95%.

I won't belabor the point much longer, other than to mention that before AIG, Citigroup (C) was added to the Dow in 1997 and was then removed in June 2009 at $3.46 per share (you can guess how brilliant of a move that was).

Not only has the timing of financial stock removals from the Dow 30 been so lousy, but they also epitomize the contrarian investment strategy inherent in these psychologically-motivated index changes. AIG and Citigroup shares have been roaring higher over the last two years. If you had to buy just one of the three stocks being removed from the Dow this time around, Bank of America looks like the obvious choice.

Full Disclosure: Clients of Peridot Capital Management were long shares of BAC and AIG at the time of writing, but positions may change at any time.

JPMorgan Sell-Off Excellent Example of Contrarian Opportunity

News of a $2 billion trading loss at JPMorgan Chase (JPM) last week prompted a 15% sell-off in the stock, which now sits more than 20% below its 52-week high, at a trailing P/E ratio of 8, at only a slight premium to tangible book value, and with a dividend yield above 3%. One of the best ways to be a successful investor is to buy quality companies at times when their share prices are temporarily depressed due to short term news headlines that likely will not impact the long term profit generation of the company. Warren Buffett has perfected this investment strategy over many decades. While JPM was not really on my radar before last week, the recent events at the company have changed that. At around $36 per share I think JPM makes for a very attractive long term investment. As a result, I have initiated a position in the company.

Full Disclosure: Long shares of JPM at the time of writing, but positions may change at any time

Despite Cyclical Headwinds, Goldman Sachs Stock Is Still Too Cheap

Shares of Goldman Sachs (GS) are rising modestly this morning, to about $98 each, after the investment banking giant beat earnings estimates for the fourth quarter. Earnings for 2011 came in at $7.46 per share, down about 50% versus last year, as the business has been struggling through a cyclical industry downturn. Still, the company made a $4 billion profit, bought back about 8% of its shares outstanding, and grew book value by 1% in 2011. And yet, the stock is trading about 20% below tangible book value of $120 per share.

I have been making this argument for a while, and holding the stock has not been fun while it has been treading water far below tangible book, but even with a cyclical industry like investment banking, GS stock should not be at these levels. It is really hard to see how the company would face a scenario where book value dropped 20% from here (which is essentially what investors are fearing when the stock trades at $98). If the sub-prime mortgage meltdown barely hit book value at Goldman, I don't see the European debt crisis doing far more damage. And even if the industry does not turn around as quickly as it has in past cycles, book value will likely go sideways or slightly higher, as we saw in 2011.

For investors to justify the idea that large, well-positioned, and profitable financial institutions should be trading far below tangible book value per share (and GS is far from the only one), one of two scenarios would need to play out. First, the companies would have to have huge unrealized losses already sitting on their books, which when realized would crush book value and wipe out the discount on the shares. Unlikely. Second, the business model would have to break down long term, rendering the firms unprofitable, which would result in a slow degradation of book value (again, narrowing the valuation gap to the downside). Again, unlikely.

Profit margins will likely drop permanently due to the Volcker Rule (no prop trading), but they should stay in positive territory (Goldman's ROE in 2011 was 6%). That should result in lower price-to-book valuations for these banks versus prior cycles, but not below one. As a result, I think GS and their strong peers should trade for at least tangible book value, which means about 25% upside from here.

Full Disclosure: Long Goldman Sachs at the time of writing, but positions may change at any time

Europe's Woes Crushing U.S. Stocks, Creating Longer Term Opportunities

You can certainly argue whether the TARP program was a good idea or not, but you cannot accuse the U.S. government of dragging their feet. They took decisive action, injected much-needed capital into the banking sector, brought confidence back into the system, and the end result was a well capitalized banking industry and a profit on the U.S. taxpayer's $700 billion investment. Unfortunately, the powers that be in Europe are taking their good ol' time to take meaningful action. Greece may be the size of Ohio, as I have repeatedly reminded investors, but as long as the markets freak out about it anyway, strong action must be taken to settle the financial markets down. We have yet to see that (hence the market's continued concern this morning), but let's keep our fingers crossed that we are getting closer.

In the meantime, there are plenty of strong companies that are being dragged down by this prolonged bailout process. Not surprisingly, most of these opportunities are in the financial sector, but in many ways are not directly in the middle of the European crisis but rather only marginally impacted. In my view, a perfect example is Aflac (AFL), the supplemental health and life insurance company whose two largest markets are Japan and the United States. As you can see from the chart below, shares of Aflac have been crushed from $59 to $33, a 44% drop from earlier in the year.

Now Aflac is not exactly the first company that comes to mind when you think about the European debt crisis. So why the huge sell-off in the stock? As a large insurance company, Aflac collects premiums from its customers and invests that capital to earn income until it needs to pay out claims. Aflac's investment portfolio amounts to a relatively large $90 billion. When investing that much money, and doing so in mostly shorter term fixed income securities, an insurance company will own a little bit of everything, and that includes debt of European countries. And therein lies the problem for the stock in 2011.

Aflac has already sold all of its Greece exposure and over the next year or so will de-risk its holdings in the other smaller European countries that people are worried about (Italy, Portugal, etc). Of course, most of Aflac's investments are outside of the troubled European countries and their underlying business is very strong. But in times of stress investors focus only on the negatives, and if any losses at all are possible from Europe, that will drive the stock down quickly.

Given the health of Aflac's business, any losses should be more than manageable. The company right now is earning more than $6 per share. At $33 per share, that puts the stock's P/E at 5.5. Such territory is nothing new for Aflac stock. During the U.S. sub-prime crisis Aflac stock also got killed, dropping from $68 in early 2008 to $10 in early 2009. The company's sub-prime exposure back then also proved to be very manageable (most of the losses were marked-to-market and never actually realized) and the stock soared nearly 500% over the following two years. I have little reason to think this time around will be much different in terms of how the company can weather the storm in the financial markets and the European debt crisis.

Full Disclosure: No position in AFL at the time of writing, but clients of Peridot Capital have owned the stock in recent years and may again in the near future

E*Trade's Largest Shareholder Pushes for a Sale, Company Hires Bankers to Explore Options

It has only been about three and a half months since I wrote about E*Trade Financial and the strong possibility that at some point the company is sold at a large premium to the then stock price of around $15 per share. Although it makes sense for the company to let its legacy loan book runoff as much as possible before exploring a sale, Citadel, with its 10% stake, urged E*Trade to sell themselves last week. The company has hired Morgan Stanley to looks at its options (though it did the same thing last year and decided to wait), and maybe not coincidentally, TD Ameritrade (long thought to be the most natural acquirer of E*Trade) has a previously scheduled board meeting this week during which buying E*Trade will surely be discussed.

My original post pegged E*Trade's value at between $22 and $27 per share and I stand by that range. E*Trade's loan book continues to runoff as expected and loan losses and delinquencies continue to trend lower every quarter (second quarter earnings were reported last week and delinquent loans fell to $1.4 billion from over $2 billion a year ago). After digging into the details of that mortgage exposure, a buyer such as Ameritrade should realize that there is very little there that should scare them out of making an offer. I don't know if a fair offer will come this year (buyers will obviously try to lowball an offer and point to the loan book as the reason why) but even if management stands by their plan from last year of waiting out a couple more years, investors will only get more for their shares. Any offer not at least in the mid 20's probably isn't in the best interests of shareholders at this time. Nonetheless, this story could get very interesting in the next few months so stay tuned.

Full Disclosure: Long shares of E*Trade at the time of writing, but positions may change at any time

Goldman Sachs Targeted Again, Entire Rebound Post-SEC Settlement Gone

So much for nailing that call on Goldman Sachs (GS) after the company settled with the SEC last year. The investment bank agreed to pay a $550 million fine last year on charges that the company engaged in fraud while selling mortgage-related investment products. The stock fell to around $130 per share at the height of the scare last July before rebounding nicely to the $175 area early in 2011. And yet here we are nearly a full year later and other lawyers are looking to get into the game. Unrelenting articles in the financial media from publications such as Rolling Stone don't help either.

Unfortunately, I thought we had gotten past this issue, at least to the same magnitude as in 2010. Wishful thinking on my part. Most of the GS stock I bought for clients last year remains in their accounts, so this latest sell-off related to additional fraud investigations by the New York U.S. Attorney's Office and the U.S. Justice Department has been painful. And with the 2012 election cycle ramping up, what better time to go after the big Wall Street banks yet again?

The interesting thing is, the issues haven't changed much since last year. It is still fairly difficult to proof Goldman Sachs committed fraud because the clear evidence that they lied directly to those buying their mortgage-related products in 2007 and 2008 is scarce. People assume that since Goldman identified a bubble about to burst, while others didn't, means that Goldman must have broken the law. And maybe they did, although the evidence I have seen is flimsy (even experts agreed that the SEC didn't have a strong case). It could just be that Goldman Sachs is smarter than most of the other players in the marketplace (a theory that has been born out for years, by the way). Every transaction requires a willing buyer and a willing seller, which means there will be a winner and a loser in every trade. Just because Goldman was the winner does not mean that they defrauded the other party in the transaction.

As was repeated numerous times during the Congressional hearings prompted by the SEC investigation last year, Goldman Sachs acts as a market maker and a securities underwriter in these deals, not as a fiduciary. As a result, they are not required to put their customers' interests ahead of their own when selling securities. All they must insure is that the investors know what they are getting and how much they are paying. Whether or not it is a good investment for them is up to the buyer to decide, not Goldman Sachs to advise them on. If there is evidence that Goldman lied to the buyers about what they were getting, then clearly the legal issue is only going to get worse for them, but again, there is hardly any evidence of that.

Even the SEC case, which resulted in Goldman agreeing to a large settlement, revolved around Goldman omitting data pertaining to which people structured the deal. All of the details of the security, including what exactly the buyer was getting, were disclosed and known by all parties involved. There has to be personal responsibility, right? If you choose to buy something and are told exactly what it is ahead of time, it should be your responsibility to decide if it is a good investment or not, and if it turns out not to be, you should expect to lose money.

Now, I am not going to pretend to know exactly what evidence will lead to what legal outcomes over the next year regarding these mortgage-backed security transactions. All I can say is that Goldman stock is now all the way back to where it was during the height of the SEC worries last year. It has given back the entire 40-point gain that was recouped after that case was closed. The company continues to have the smartest people in the investment banking universe and be the premiere firm to do business with. Their profits remain strong and the stock trades near tangible book value after the recent correction. Goldman Sachs since their IPO in 1999 has proven again and again they can create shareholder value in all market cycles. Consider the chart below, which shows GS's book value per share growth since the company went public more than a decade ago. As you can see, the company is run superbly well, which usually warrants a sizable premium to book value.

For long term investors it appears to be a great buying opportunity, the same conclusion I made at about this time last year. Of course, if the stock should rebound 40 points again after more lawsuits are resolved, perhaps it would be wise to take some more money off the table, as this issue doesn't seem like it will be going away anytime soon.

Full Disclosure: Clients of Peridot Capital were long shares of GS at the time of writing, but positions may change at any time