As the new year has begun the same way the prior one ended (a slow melt-up in stock prices without much in the way of concern from any corner of the market), I can't help but get the feeling that complacency is extremely elevated and investors are mostly bullish.

Can the U.S. equity market keep up this trajectory:

Can market volatility remain this benign, as the Wall Street Journal reported this morning:

"The S&P 500 is in one of its longest streaks without a 1% daily move in the past five decades, highlighting how the latest leg of the stock-market rally has been a gradual climb rather than a euphoric surge. The broad equity gauge hasn’t moved 1% or more in either direction since mid-October, its sixth-longest streak since the end of 1969 and third-longest since the end of 1995, according to Dow Jones Market Data. Driving the extended period of calm trading: An initial U.S.-China trade deal and lower interest rates around the globe that have eased fears of a sharp economic slowdown."

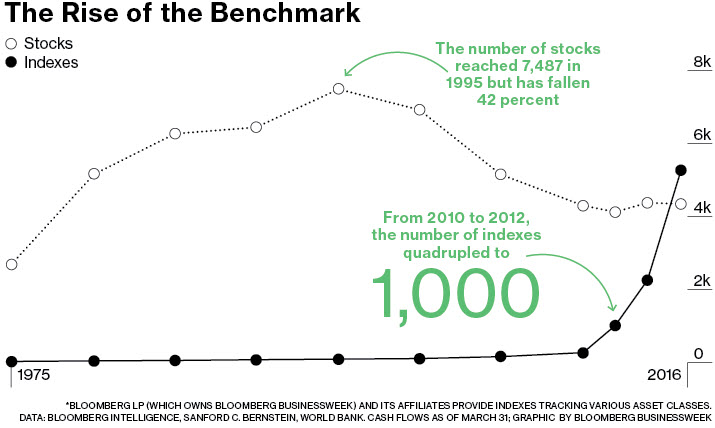

A big indicator of investor complacency continues to be the popularity of index funds. The sheer number of indexes being created should give us all pause. Consider the following two stats:

1) As of the end of 2017, there were more than 3 million stock market indices worldwide, more than 70 times more than the number of public companies (43,000).

2) The story is similar in the U.S. alone: as of 2016, there were about 4,000 U.S. stocks but more than 5,000 indices containing them, according to Bloomberg:

While I don't have updated data, it is safe to assume the gap is even wider now that a few years has passed and the trend is not slowing down. It boggles the mind, really. Imagine a professional sports league with more teams than actual players. It is just not logical.

After a decade where the main index, the S&P 500, posted 14% average annual returns, it is easy to see how recency bias is forcing investors to conclude that indexing is the only strategy worthy of consideration. But let's not forget that the markets are cyclical, just like the economy and investor sentiment. With the P/E on the market now above 20x, a level that historically has warranted caution, and the 5 largest stocks now comprising nearly 20% of the S&P 500's market value, there are real signs that investors have set everything to auto-pilot and expect the tech sector to continue to drive the indices higher indefinitely.

All of these factors taken together make me nervous. That is not to say that it has top end soon and in dire fashion (there are plenty of plausible outcomes), but I would not want to make a strong consensus bet that the next 1-0 years will look similar to the last 10.