We hear a lot about the "FAANG" stocks (Facebook, Apple, Amazon, Netflix, Google/Alphabet) leading the S&P 500 higher in recent years, which is undeniably true, so I decided to take a look at a slightly modified version to see where valuations are within the group.

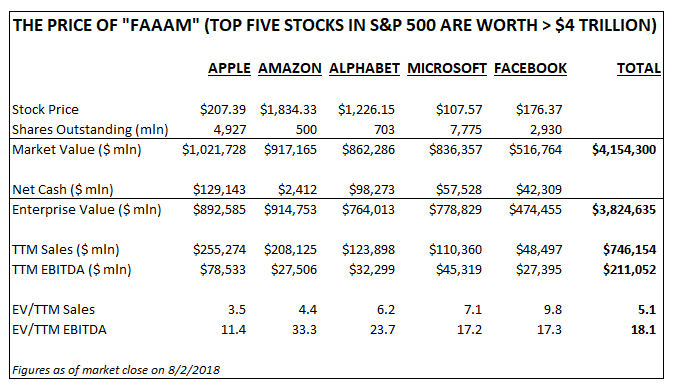

Below you will find data on "FAAAM" which I have coined to represent the top 5 most valuable companies in the S&P 500 today. By adding Microsoft in place of Netflix, we have a fivesome worth more than $4.1 trillion, or about 16.5% of the entire S&P 500 index ($25 trillion total value).

There are many conclusions investors can gleam from this group of tech stocks, and not everyone will agree. I will share a few of my views and feel free to chime in.

While not unprecedented, having such concentration within the dominant U.S. equity index means that near to intermediate returns for the market are largely correlated with large cap tech leaders. Given that none of the valuations are inexpensive, and Apple is probably the only one that looks to be no worse than fairly valued, investors relying on this group for future returns will need growth rates (in revenue and earnings) to continue at high rates for quite a while. It is hard to know whether this expectation is reasonable. For instance, will the size of these firms lead to slower growth by default, or are they dominant enough to continue to garner the lion share of the sector's growth overall?

At 18x EV/EBITDA, are the valuation of this group reasonable enough to expect that the stocks, on average, can generate double-digit annualized returns over, say, the next 5-10 years? If 20% annual growth rates in the underlying businesses persist, then the valuations are not likely too high, but that is a big open question. For instance, Amazon's revenue in 2018 is projected to reach $235 billion (current analyst consensus estimate). To keep growing at 20% per year, the company needs to find an incremental $50 billion of revenue every year, which equates to $1 billion every week! The stock is priced as though such an outcome is likely. What happens if revenue growth slows to 10%?

Of the five companies in "FAAAM" the only ones I would consider putting fresh money into, based on growth and valuation, would be Apple and Facebook. Apple's run to $1 trillion this week on the heels of a strong earnings report could signal the stock is topped out in the near-term. Facebook, however, trading down lately after ratcheting down growth expectations on their latest conference call, is really the only FAAAM stock that is down materially at all. While I am not exciting to buy any names in the group at current prices, they could very well have the best mix of untapped growth opportunities and less-than-exuberant investor sentiment.