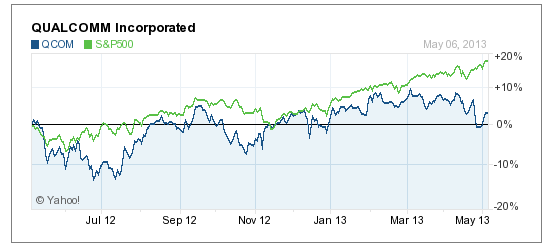

Qualcomm (QCOM), the leading provider of chipsets for wireless consumer devices, has seen its stock price underperform the S&P 500 index over the last year (see chart below), which could prompt shareholders to get more vocal about the company's sub-optimal capital allocation practices later this year. We have seen with Apple that hoarding capital can negatively impact the multiple that investors are willing to pay for a company's shares. In fact, Apple's stock has rebounded nicely in recent weeks, after the company announced it was increasing the size of its share repurchase program by 500%, from $10 billion to $60 billion.

Believe it or not, Qualcomm's cash hoard has eclipsed the $30 billion mark as of March 31st, though the company has no debt. On a relative basis, this is actually more anti-shareholder than Apple. QCOM's cash amounts to 1.4 times the company's annual revenue, 4 times annual cash flow, and more than 26 years' worth of capital expenditures. Compare that to Apple's $145 billion of cash as of March 31st, which comes to 0.85 times annual revenue, 2.5 times annual cash flow, and more than 14 years' worth of capital expenditures.

For investors interested in Qualcomm as an investment, the future will clearly be impacted by how (or if) the company's capital allocation actions change over time. Just as Apple's share price plunge from over $700 to under $400 resulted in a louder chorus from investors about the return of cash, continued underperformance by QCOM stock might just have the same impact. The company certainly does not need $30 billion of cash sitting in the bank.

Full Disclosure: Long Apple and no position in QCOM at the time of writing, but positions may change at any time