I touched on the issues Amgen (AMGN) is having with Aranesp a couple months back, but I decided to take a closer look at the numbers after the latest news that an FDA panel recommended further studies and label changes for the company's anemia drug franchise. Such recommendations should not have been surprising given that a label change was already in the works (albeit less severe) and companies do follow-up studies on existing drugs all the time to measure long-term effects. Is the company going to lose as much business as Wall Street seems to be pricing in? I decided to take a look.

The main concern with Aranesp is that the drug is approved for patients with hemoglobin levels below 12. However, there is off-label usage going on at higher levels, and the FDA is concerned that such usage may increase cancer patients' risk of developing other health problems. Amgen stock has been crushed on these concerns.

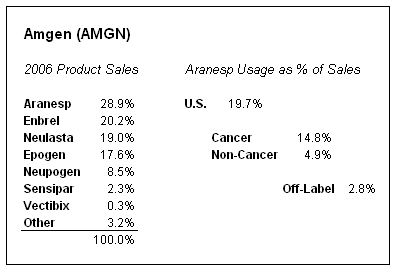

The media and Wall Street community has been focused on the fact that Amgen's two anemia drugs, Aranesp and Epogen, represented 46% of the company's sales in 2006. If you leave the analysis at that, then dramatic changes in prescription trends for both drugs would appear quite damaging. However, if you dig further to single out the areas of concern, you learn that Aranesp sales in the United States (where the FDA and label changes will have an impact) represent less than 20% of Amgen's business. Recommendations for Epogen (which is used in dialysis patients) is not going to be known until later this year. Furthermore, off-label use is an extremely small percentage of total script volume, so even if Amgen loses all of that business, it won't be catastrophic, as the chart shows (data courtesy of Amgen).

The FDA panel was focused on patients with chemotherapy-induced anemia (CIA) and anemia of cancer (AoC), and especially with off-label uses in those with hemoglobin levels above the targeted range of 11-12. As you can see, only 15% of Amgen's sales in 2006 came from cancer patients taking Aranesp, and less than 3% came from off-label use.

Now, does this information warrant such a dramatic sell-off in the stock? It depends on how much business you assume Amgen is going to lose. If Aranesp revenue was going to go away all of the sudden, then yes, it would be very painful news for Amgen. But doctors are not going to stop prescribing the drug to most patients because the vast majority are using it as intended.

If we make some reasonable assumptions, not allowing Wall Street's reaction to influence our thinking, we can come to a much more logical conclusion about Amgen's future. Let's assume Amgen loses all of its sales from off-label use. If the FDA issues similar recommendations for Epogen in the fall (which seems likely), that would result in a 5% hit to Amgen's annual revenue. We can further assume that some on-label scripts will be lost due to some doctors getting nervous, combined with some who have borderline high hemoglobin levels and choose to cut back just to be safe.

Even if we assume that on-label sales drop off by a substantial 25% for both drugs (which seems like a high number to me), Amgen will see an overall sales drop of 10 to 15 percent. They would likely be able to offset some of that with cost-cutting, as they indicated they will do in their last quarterly conference call. The overall effect on earnings might only be 5-10 percent. Meanwhile, the stock is down nearly 30 percent, and may even be putting in a double bottom around $55 per share.

Full Disclosure: Long shares of Amgen at time of writing