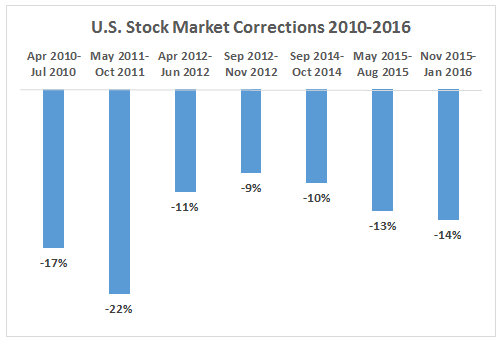

You might be freaking out now that the U.S. stock market has dropped more than 8% during the first two weeks of 2016. With only nine trading days under our belt (including today) it has been a rough start to the new year. It has not helped our mental conditioning that from 2011 to 2015 we had a four-year stretch of no market corrections. Over the last six months we have now seen drops of 10% or more on two separate occasions. It also does not help that the national news typically only covers the stock market on days when the Dow drops 300 or 400 points, rather than giving equal time when it rebounds.

All of this is going to be okay. The shift from human to electronic trading has allowed computers to take over the process, which means much faster transacting. The result is that moves up and down now happen much more quickly. Market shifts that once took week or months can now come and go in a matter of minutes or hours. A 10% market correction might have taken three months a couple decades ago but now can take three days.

The ever-changing global economy also contributes to the volatility. We never heard much about China twenty years ago but now our financial markets can react violently to swift declines in Chinese stocks, even when their impact on American companies is minimal. As the United States matures and other countries grow faster and contribute a higher portion of global economic output, we become less shielded from international markets and therefore we will feel more ripple waves. And that's okay.

Advances in technology more generally have also had consequences for those of us who are investing for our futures. Information can now be transferred across the globe in a matter of milliseconds. While that is great for a level playing field and means we can research our investments more quickly, easily, and cheaply than ever before, it also means that there is more to react to. More information and quicker dissemination of that information has its drawbacks; namely volatility. Engineers are now even programming computers to automatically place buy and sell trades based on information delivered online. So not only do we get information faster, but we can act on in it much faster too.

And then there are new financial products being created all of the time. More ways to "play" means more money flowing in different directions, which also increases volatility of the underlying prices for assets. As the great new movie "The Big Short" conveys so well, financial derivatives allow more money to be wagered on various outcomes than ever before. As the analogy goes, you used to be the only one who could buy insurance on your own house or car, but now an unlimited number of people can do so. Imagine how volatile the price of insurance will be when it trades daily and anyone can buy it on practically anything.

By now you are probably thinking that I have changed my mind in a few paragraphs and everything will not be okay. Nope. The saving grace is that business profitability does not swing nearly as much as asset prices do. And over the long-term asset prices are going to track the underlying fundamentals of a business. As long as we are willing to not panic and sell when things turn south for a little while, the near-term price gyrations should not matter. And no matter how hard it is to accept this fact and not panic, that is what investing requires. I try to do the best job I can reinforcing this with my clients, but it is a tough job. Emotional reactions are natural and difficult to ignore.

My focus right now is on fourth quarter earnings reports and 2016 commentaries which are getting under way. Doing so will allow investors to separate what is going on daily in terms of asset prices and how the underlying fundamentals of companies look. After all, five years from now stock prices will reflect underlying earnings more than anything else. Five days or five weeks from now they can reflect anything at all.

PS: Some people may argue with that last point. After all, if markets get wacky five years from today what is to say that the underlying profits of the company will matter? That is a fair statement, to some extent. I think it is important to point out that history has shown that stock prices, while volatile, do not have an unlimited range of outcomes. The S&P 500 has traded as low as 7-8 times earnings during periods of double-digit interest rates and as high as 25-30 times earnings during bubbles. But it has never traded for 3 times earnings or 100 times earnings.

Why is this important? Let's say you buy a $100 stock today that trades for 10 times earnings and pays a 5% annual dividend. Your underlying investment thesis is that it will grow earnings per share by 10% annually for the next five years and continue to pay the dividend, which will be increased at the same rate as the underlying earnings grow.

If your fundamental analysis of the company turns out to be accurate, and you do not sell the stock (even during times of market panic), five years from now you will have collected more than $30 per share in dividends and the company's earnings will have grown from $10 to $16 per share. Assuming this plays out, what is the worst case scenario in terms of investment return? Even if the stock trades at only 7 times earnings, the stock will still trade at $112 per share. Add in the $30 of dividends you collected and your total return would be more than 40% over a five-year period, or about 8% annually.

Simply put, you are not going to lose money on that investment, as long as your thesis about earnings and dividends is right. This is important because we could not say the same thing if we only look out five weeks or five months into the future. If the stock drops to 7 times earnings in the short-term you would lose 30% on paper even if the company's fundamentals were on track. As long as you do not overpay for something, being right on the fundamentals and holding for the long-term becomes a winning proposition. That is why I spend the bulk of my time researching companies and hammering home the long-term nature of my investments.