"The backlog of unsold new homes reached a record level last month, as sales slipped despite the warmest January in more than 100 years. The Commerce Department reported Monday that sales of new single-family homes dropped by 5 percent to a seasonally adjusted annual rate of 1.233 million units last month. That was the slowest pace since January 2005 and left the number of unsold homes at a record high of 528,000."

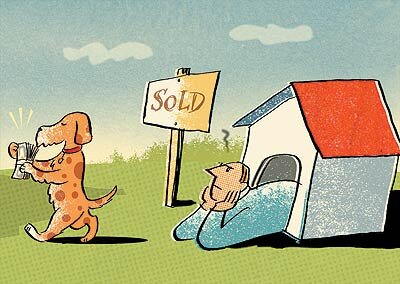

The housing boom is over folks. Inventory data is crucial for real estate. There is no magic formula for calculating fair value of residential housing. You can't run a discounted cash flow model, or dividend discount model. Housing prices are simply based on supply and demand. And supply is at an all-time high.

Even here in St. Louis, hardly a booming market, I am seeing more and more houses going up for sale, even though others have been on the market for months. Mortgage rates are up and millions of ARM loans readjust this year. Home equity loan rates are also on the rise. Fed Funds will hit 5% this year, which puts the prime rate at 8% and most home equity loan rates at 9%.

It's not a complex scenario. Supply is high as the inventory numbers show. Interest rates, the cost of money, are going up and will adversely affect demand. Not a good combination. Housing stocks may look attractive with low P/E ratios, but don't forget why housing stocks always have low multiples; because the cycle always ends.