As usual, quality insights from the manager of Legg Mason Value Trust in his latest shareholder letter dated February 10, 2008. In my view, a couple are definitely worth posting:

On the constant chatter of possible recession:

Investors seem to be obsessed just now over the question of whether we will go into recession or not, a particularly pointless inquiry. The stocks that perform poorly entering a recession are already trading at recession levels. If we go into recession, we will come out of it. In any case, we have had only two recessions in the past 25 years, and they totaled 17 months. As long-term investors, we position portfolios for the 95% of the time the economy is growing, not the unforecastable 5% when it is not.

On Microsoft's offer for Yahoo:

"The 60% premium MSFT offered for YHOO highlights what we believe are the significant opportunities present in our portfolios. Clients and shareholders are understandably disappointed when the performance of their portfolio does not keep pace with the broader market. But the price of a publicly traded security is one thing, and its value is something else. Price is a function of short-term supply and demand characteristics, which are heavily influenced by the most recent news and results. Value is the present value of the future cash flows of the business, and that is what we focus on."

Straight Talk from Buffett

One of the great things about listening to Warren Buffett speak, and I suspect one reason why thousands gather each year in Omaha for his company's annual meeting, is that despite the fact that he is a brilliant man he speaks in plain, logical language that is easy to follow and usually hard to argue with. If you want the truth, without the media spin, and in as few simple words as possible, just ask Buffett.

Here are excerpts from a Buffett blurb on latimes.com from Thursday discussing current financial market conditions:

"It's sort of a little poetic justice, in that the people that brewed this toxic Kool-Aid found themselves drinking a lot of it in the end," he said.

"I wouldn't quite call it a credit crunch," he said. "Money is available, and it's really quite cheap because of the lowering of rates that has taken place."

He added: "What has happened is a repricing of risk and an unavailability of what I might call 'dumb money,' of which there was plenty around a year ago."

He is so right on this. People in the media keep complaining that "banks aren't lending money anymore" and the Fed has to help boost liquidity. Banks are still lending money, they are just doing so only to people who have good credit (and thus actually deserve to be given loans).

It's funny that people complained that the banks were giving loans to anyone and everyone, and now they are upset because many people can't get loans anymore. You can't have it both ways.

The fact that "dumb money" is no longer available is a good thing. Perhaps retail sales drop a few percentage points and loan losses increase a few because of it, but overall our financial system will be less leveraged and healthier as a result.

If you can't put any money down or verify your income, you can't afford to buy a home. I'm glad the banks are finally realizing this. And for those who are credit worthy, the Fed is lowering borrowing rates so the banks can make money on the loans they are willing to extend.

Cross Your Fingers

Maybe we can hold here:

With Negative Sentiment Soaring, We Might Be Starting A Bottoming Process

One of the stranger things about 2007 was the huge discrepancy between different areas of the U.S. stock market. Despite widespread problems, the stock market didn't fare badly unless you looked under the hood. The S&P 500 finished the year up 5%, hardly indicative of the issues we are facing. In fact, of the market's ten major sectors, only two of them trailed the S&P 500 index's return last year. Financial services (-21%) and consumer discretionary (-14%) stocks were correctly pricing in a recession (or something that feels like one) but the other eight sectors just kept humming right along.

Well, it appears we are now getting a more realistic reaction in the market to the economic challenges we are dealing with. We've dropped 10% in less than 3 weeks, and the selling has been much more widespread. Realistically, we were due for this type of action. That said, the negative sentiment in the market right now is deafening. We won't know how bad things really are until fourth quarter earnings reports and first quarter outlooks are given out over the next 2-3 weeks, but stock prices are starting to price in some really bad stuff. Many contrarian sentiment indicators are signaling we could be starting a bottoming process.

Since nobody can predict when the market will stop going down, I'm not going to waste my time (or yours) hazarding a guess. I will say this, however. Investors should pay close attention to this month's earnings reports and conference calls. Stock prices are now being driven by fear, and I think many of them are not reflecting what is likely to happen as we navigate through 2008. We could certainly fall another 5%-10%, after all things are not good and I'm not trying to say they are, but we should still be getting ready to pounce.

Personally, I am not going to be doing any meaningful buying until I see these earnings reports and listen to quarterly conference calls. But after that, I think it might be time to dip a toe in the water with cash positions. Even if we keep heading lower short term, a year or two from now I think it will pay off in spades.

Earnings Estimates for 2008 Appear Overly Optimistic

Although fourth quarter earnings reports just started to trickle in, consensus estimates call for 2007 S&P 500 profits to be essentially flat with 2006. Given the huge year-over-year declines in the financial sector, the largest piece of the index, this is not very surprising.

What is surprising is that analysts are projecting 2008 earnings to grow by more than 15%. We all know that analysts are rarely spot on with their forecasts, but the possibility of this number being accurate seems even less likely than normal. While the market's P/E using the current forward estimate (less than 14) is not high by any means, bullish investors hoping for a solid market gain this year (at or above historical averages) likely need strong earnings growth to make the case.

Given the economic backdrop right now, a less impressive year in the market (more in line with last year) seems like a more reasonable expectation. As far as the economy goes, 2008 probably will be more of a "sorting out" year than a "snap back" one. As a result, I think the return of double digit earnings growth for the S&P 500 likely won't return until 2009 at the earliest.

What To Do When Investments Turn Into Great Trades

John from California writes:

"I know you are a long term investor, but given that one of your 2008 Select List picks just went up 30% in a matter of days, I'm stuck as to what to do, sell or hold on? Any thoughts?"

John, thanks for the question. A common answer to this dilemma (feeling compelled to book gains even if your time horizon has not played out yet) is to sell a portion of the position. This gives you the best of both worlds by booking some profits but staying in the stock. Oftentimes I will sell half of a position if I'm really torn about what to do.

However, this works best with large gains (say 100%) because you accomplish both taking a lot off the table and maintaining a sizable position for meaningful further gains. With a 30% gain, however, selling half brings your overall position size down to about one-third less than the level it was less than a week ago, which could very well be too small for your taste.

In that case, I might consider selling 20%-25% rather than 50% in order to keep a full sized position for the long term. After all, the Select List is geared for intermediate to long term investors, even if gains over the first week for one of the picks was unusually high. Hope that helps.

Third Time's A Charm?

Earnings season officially kicked off this afternoon, with Alcoa (AA) reporting fourth quarter numbers. Given the worries about the economy, these profit reports obviously carry as much as weight as anything in determining market direction, but they also come at a time when the S&P has once again dropped down to a support area between 1350 and 1400. Since I am not of the belief that the Fed can cure all of our ills on its own, the next few weeks are crucial to whether or not we can maintain these levels again, or if a wider bear market (not just in financials and consumer discretionary stocks) awaits us.

Putting the Correction in Perspective

November has been the worst month for stocks in several years. The S&P 500 is now negative for the year, and sits 10% below its high and 8.5% lower this month alone. Not only do long term investors like myself take a multi-year outlook of the future when investing money, but it also helps to put things in perspective by looking back at where the markets have come from in a multi-year scenario. Much like a student who gets a C on a tough exam might be in fine shape if previous grades in a semester have been all A's, investors need to realize that markets don't go up all the time, just as good students can't possibly ace every test.

Stock prices rise, on average, 75 to 80 percent of the time in any given year. After four magnificent years of gains in the market, we are overdue for some poor performance. We might finish down this year, or next year, or both, but regardless, take a look at how far we have come over the last five years:

We can't possibly expect gains like this to continue indefinitely. Even a pullback to something like 1,300 on the S&P 500 index would simply be a normal, healthy retracement after extremely large gains. Perspective like this is important when markets are rattled, as they clearly are right now. I don't know how long the correction will last, or how low we will ultimately go, but I will remind people that these types of moves are normal, and are required to maintain a healthy marketplace.

As for how to approach new investments in this type of environment, I don't think meaningful changes need to be made. When fear of the unknown grips markets in the short term, as is happening right now, long term investors simply need to ignore the short term noise and focus on long term fundamental stories. Investment themes need to be able to weather your view of how the world will look five years from now, not five hours from now. If you invest in a company that has a bright long term future, and pay a very reasonable price for it, the odds are in your favor that you will make good money over time. And that fact won't change based on anything that happens today, next week, or even in 2008.

As Usual, Bill Miller's Letter is a Good Read

I've been a follower of Legg Mason's Bill Miller for a long time. Having grown up in Baltimore, where Legg Mason is based, I was able to learn a lot about him and his investment strategy before most others did so via the publicity surrounding his stunning 15 straight years of beating the S&P 500 index. Miller is a contrarian, value investor, just as I am. And although I don't always agree with his stock picks, his insights into the market and long term investing are particularly well written. I even quote him on Peridot Capital's web site, because he is far more articulate that I am when addressing many important investment concepts. You can usually learn something by reading an article about him, or his actual letters to investors, which are published every 3 months.

Last week, Miller's third quarter commentary was especially insightful, as it addressed many of the turbulent events of the recent past and explained how he views the current marketplace. I've provided a link to Miller's third quarter letter to investors for those of you who are interested. I suggest that long term contrarian investors add the letters to their personal reading list on a quarterly basis.

The Implications of Negative Earnings Growth

Undoubtedly, the underlying driver of the U.S. stock market in recent years could be summed up in two words; earnings growth. Equities now face a hurdle, however, as third quarter profits for the S&P 500 could very well decline year over year for the first time in five years. The implications for the market are pretty important.

At the outset of the year, market forecasters were calling for low to mid double digit returns for the market, supported by rising earnings and slight multiple expansion. It was my view that multiple expansion was unlikely (due to a lack of low P/E ratios to begin with, coupled with decelerating economic and earnings growth rates), so market returns would more likely track earnings advances, which would put us up in the mid to high single digits for the year. The S&P 500 is slightly above that pace right now, but it will likely be an uphill battle from here.

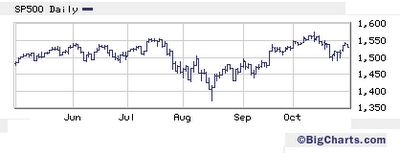

The reason is that without multiple expansion or earnings growth, there is no way for the market to advance meaningfully, by definition. The end result is likely to be a range-bound market as judged by the major indices. In fact, as the chart below shows, we have already begun to see this scenario take shape.

S&P 500 Index - Last 6 Months

From an investor perspective, this infers that stock picking will be all that more crucial to achieve investment gains. Not surprisingly, I would suggest focusing on individual situations where either multiple expansion or earnings growth are largely assured. The ideal investment candidate would be set up nicely for both, which would allow for solid gains regardless of whether or not the overall market advances meaningfully in coming months.