With all of the new competition aiming squarely at Whole Foods, how can they possibly compete effectively and continue to post strong financial results for their shareholders? Recent stock market action is telling us that investors have given up on the company. The media headlines have been extremely negative too. Nonetheless, in the face of extreme pessimism, I am a buyer of the stock. Let me tell you why.

There is no doubt that Whole Foods is facing more and more competition every day. For years people thought the natural foods business was a niche market, but now they are coming to realize that it has gone mainstream in many markets across the country. Not only have traditional grocery stores added natural and organic sections to their stores, but smaller Whole Foods wannabes are popping up too. In fact, many of them are newly public, such as Sprouts Farmers Market (SFM), Fresh Market (TFM), and Fairway (FWM). But guess what? They can all coexist.

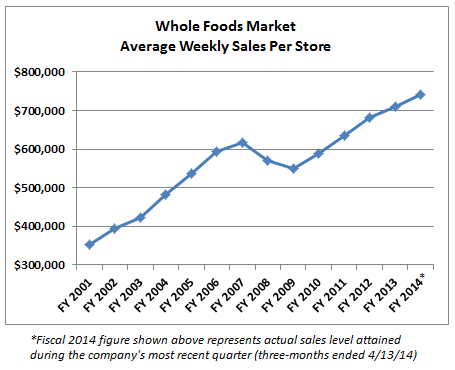

As consumers opt for healthier food, natural foods will increase their share of the overall food market and there will be plenty of room for multiple players to operate stores profitably. Witness Whole Foods' +4.5% same store sales number for last quarter. If people were really leaving Whole Foods and switching to these other stores (the bears say price will be the biggest reason), their sales would not be rising faster than the rate of food inflation. Despite new competition (Sprouts and Fresh Market combined have nearly as many stores nationwide as Whole Foods, and all three are doing very well), Whole Foods has a very loyal customer base and there are few signs that they will abandon Whole Foods.

I think a great way to think about the future of Whole Foods is to compare it to another strong pioneering consumer brand that sells a high-end product to a very loyal customer base and has faced enormous competition over the years; Starbucks (SBUX). The similarities to me are uncanny. Think about how many companies have tried to eat into Starbucks' growth in the specialty coffee market. Scores of local coffee shops have popped up urging you to support your neighborhood business, and big players like McDonalds (MCD) and Dunkin Donuts (DNKN) have littered the market with me-too coffee options. And what happened? Did Starbucks' customers flee in favor of a slightly less expensive drink? Not at all. Interestingly, the new players did well too. Both Dunkin and McDonalds sell a lot of coffee, even as Starbucks continues to thrive.

That is exactly how I see the natural foods story playing out. Whole Foods Market will cross the 400 store mark later in 2014. Ultimately they see room for 1,200 stores in the U.S. alone. Their growth is far from over and I expect them to continue to be seen as the leader and industry pioneer for many years to come (just like Starbucks).

Here's the best part; the stock is cheap and most people don't realize it. At first blush it doesn't look undervalued. Whole Foods will earn about $1.50 per share this year and trades at 25 times earnings. A 50% premium to the S&P 500 for a growth company facing stiff competition doesn't seem like a bargain to most casual onlookers. But you have to dig deeper to see the value.

Since Whole Foods has high capital needs (as it opens new stores at a rapid rate), the company's operating cash flow dwarfs its reported earnings per share. Depreciation expense last year came to $370 million, or about $1 per WFM share. In fact, WFM generated about $2.70 per share of operating cash flow in fiscal 2013. All of the sudden that 25 P/E multiple comes down to about 14x operating cash flow if you look at actual cash generation.

It gets better. Of that $2.70 of operating cash flow Whole Foods spent more than half of it on capital expenditures, and of that, about two-thirds went towards new store construction. As a result, when we calculate how much cash profit every WFM store generates, we arrive at an impressive $2.25 million. With an expected 400 stores at year-end (which will generate $900 million of free cash flow annually), we can assign a value to the existing WFM store base only, excluding all future development. If we use a very reasonable 15x free cash flow multiple (a discount to the S&P 500), we conclude that the existing store base is worth $13.5 billion.

And that's the best part of the story. At current prices, Whole Foods trades at an enterprise value of $13 billion ($14.5 billion equity value less $1.5 billion of net cash). That means that investors at today's prices are buying the existing stores for a very fair price and are getting all future store development for free.

If you share my view of the natural food industry and believe that Whole Foods can continue to be a leader in the market, even in the face of increased competition, then investors at today's prices are likely going to do extremely well over the next 5-10 years. After all, WFM is only about 1/3 of the way to their goal of 1,200 U.S. stores, and today's share price does not reflect the likely upside from years and years of future development.

Full Disclosure: Long shares of WFM at the time of writing but positions may change at any time.