Warren Buffett's annual letter is always a good read and the recently released 2007 version is no different. There are a couple points that Buffett mentions this year that I think are worth pointing out and commenting on regarding the current market environment; corporate creditworthiness and sovereign wealth funds.

Buffett is often criticized for speaking out against the widespread use of derivatives and at the same time, initiating derivatives positions for Berkshire. However, just because certain derivatives are extremely risky and may pose a serious threat to our financial system, that does not mean that every single derivative contract is bad. There are many derivatives that do not use tons of leverage and pose little threat, and those are the ones Buffett is using.

In the letter, Buffett points out that Berkshire has entered into 94 derivative contracts which fall into two categories; credit default swaps and long term short put positions on several equity indices. The former is interesting because corporate credit spreads have widened dramatically recently, and investors are worried that default rates are set to spike in coming years.

Buffett has decided to insure bondholders against default over the next five years, and in return has received more than $3 billion in premiums for these contracts. He is betting that actual corporate defaults are less than the rates currently implied by the market prices of credit default swap contracts. Given that current prices are artificially high for credit protection, due to the unstable credit markets, the implied default rates right now are well above typical historical loss rates at the end of an economic cycle.

What does this mean to individual investors? It means that high yield bonds are extremely depressed right now and many smart investors are betting that the market for corporate debt has swung too far into the pessimistic camp. If you agree and believe that although earnings might fall in coming years for certain companies, they will still be able to repay their debt, then high yield bonds and credit protection are interesting areas for investment. Investors can play this two ways.

First, you can simply buy high yield corporate bonds or bond funds. High quality managers are salivating at some of the yields currently available in the corporate bond market and are more than willing to wait out this economic downturn, collect interest payments, and get repaid several years down the road if their financial analysis proves accurate.

You can also invest in a company like Primus Guaranty (PRS), a small publicly traded writer of credit default swap contracts. Essentially, Primus is doing exactly what Buffet has done, but they do it for a living. As credit spreads widen and premiums rise for selling credit protection, Primus will do more business at more lucrative prices.

Another point Buffett raises in his letter that I think is interesting is the rise of sovereign wealth funds. For those of you who are unfamiliar with the term, these are simply government owned investment funds of foreign countries. As the global economy has expanded and the developing world sees increased economic prosperity, foreign governments are flush with cash, and like anyone else in that situation, are looking for places to invest it.

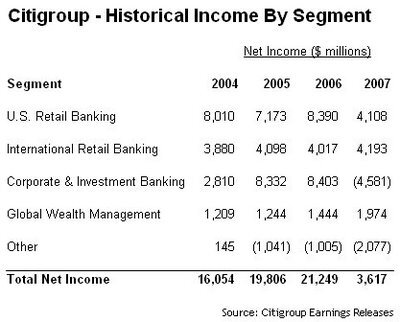

As the world's biggest market, it is not surprising that the U.S. has seen China buy a 10% stake in the Blackstone (BX) IPO and Abu Dhabi invest in Citigroup (C). Of course, some on Capitol Hill are worried about foreign money being invested in U.S. companies. Although these are passive investments, and bring with them no control of operations, national security concerns are being voiced by many.

Buffett makes the point that this trend is largely the product of our own doing. The U.S. is racking up huge deficits, issuing debt to any foreign country who will buy it, and the resulting weak dollar is prompting foreign investors to invest in U.S. equities. They are simply diversifying their investment portfolio. After a while, you can only buy so much U.S. debt without getting a little worried about our country's financial health. Many U.S companies, although navigating through tough times, look more attractive than the government does for investment dollar allocations.

As a result, foreigners want to buy equities as well as bonds. Buffett points out we certainly can't blame them for buying stocks rather than more bonds. And it is much easier for them to do so now because so many financial institutions are trying to raise capital after sub-prime mortgage blunders. In my view, as long as these remain passive investments, we really can't complain. When operational decision making becomes as issue, as it was when an Abu Dhabi firm wanted to run our ports here in the U.S. (the deal was squashed), then it makes sense to talk about national security threats, but only when a real threat is apparent.

Full Disclosure: No positions in the companies mentioned at the time of writing